|

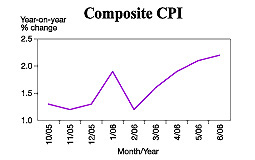

On the rise: June saw a larger year-on-year consumer price increase, with overall costs up 2.2% over the same month last year. |

|

June saw a larger year-on-year consumer price increase, with overall costs up 2.2% over the same month last year and 2.1% on May's growth, the Census & Statistics Department says.

The rise was mainly attributable to enlarged increases in the price of fresh vegetables and charges for household services.

In June, year-on-year increases in prices were recorded for housing (4.9%), food (excluding meals bought away from home) (3%), electricity, gas and water (2.4%), miscellaneous services (2.1%), miscellaneous goods (1.9%), meals bought away from home (1.5%), transport (0.6%) and clothing and footwear (0.4%).

Year-on-year dips in prices were recorded for durable goods (-6.7%) and alcohol and tobacco (-4.6%).

For the first half of 2006 as a whole, the Composite Consumer Price Index rose 1.8% over a year earlier. In the second quarter, the Composite CPI rose 2.0% over a year earlier.

For the 12 months ending June, the Composite CPI was on average 1.6% higher than in the preceding 12 month period.

Inflation edging up

Consumer price inflation edged up but was still moderate in June, amidst the continued expansion of the economy.

The sustained feed-through of higher private housing rentals, the faster increase in food prices, and the elevated energy prices had brought greater pressure on consumer prices. Yet this was offset to some extent by the relatively mild increases in prices of other consumer goods and services.

Looking ahead, consumer price inflation is likely to remain moderate in the coming months. The continuous expansion in production capacity coupled with rising labour productivity as a result of strong investment in the previous quarters would help alleviate pressure on local business costs.

Import prices of consumer goods remain soft amidst the strong global competitive pressure. Yet there are certain upside risks, including the higher oil prices and the gradual building up of inflationary pressures in Hong Kong's trading partners.

Go To Top

|