|

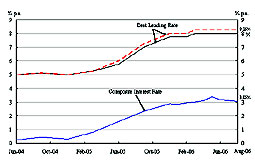

| Lower rate: The composite interest rate fell six basis points in August to 3.05%. |

August's composite interest rate fell six basis points from July, to 3.05%, the Monetary Authority says. This followed a fall of five basis points in July.

The fall in the average cost of funds in August was attributable to the drop in time deposits and interbank rates. One bank lowered its best lending rate by 25 basis points and its savings deposit rate was also cut from a maximum of 3% per annum to 2.75%. But all other banks kept their rates unchanged.

Quoted time deposit rates of eight major banks were steady for deposits with maturity of one month and over, while that for deposits with maturity of seven days dropped three basis points. Meanwhile, Hong Kong interbank offered rates for funds with maturity of three months and over fell three to 20 basis points, while that for funds with maturity less than three months rose seven to 22 basis points. On a month-average basis, the interbank offered rates for funds of all maturities dropped 13 to 31 basis points.

Since the commencement of the current up-cycle of US interest rates from the middle of 2004, the composite interest rate has surged 281 basis points, compared with the upward adjustments of between 300 and 325 basis points of banks' best lending rates.

|