|

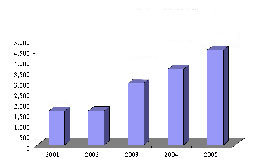

| Upward trend: The total asset size of the combined fund management business in Hong Kong grew 25% last year, to $4.53 trillion. |

|

The total asset size of the combined fund management business in Hong Kong grew 25% last year to $4.53 trillion, according to a Securities & Futures Commission survey.

Commission Executive Director of Intermediaries & Investment Products Alexa Lam said this is a testimony of the professionalism, enterprise and hard work of Hong Kong's fund managers and advisers. The commission will work in partnership with the industry to anchor Hong Kong's position as Asia's asset management hub.

Licensed corporations

The survey found licensed corporations are still the major player. They reported $3.46 trillion in assets under management and advisory businesses. An additional $38 billion worth of assets were managed in the form of real estate investment trusts. In aggregate, they represented 77% of the combined fund management business. Registered institutions accounted for the remaining 23%, or $1.031 trillion.

Last year Hong Kong continued to be a leading fund management centre in Asia, with 63% or $2.83 trillion of the non-REITs fund management business assets sourced from overseas. In terms of value, assets sourced from overseas registered a 25% year-on-year growth.

The survey also found 53% or $1.73 trillion of the total non-REITs assets under management were managed onshore. The size of combined fund management business was equivalent to 55% of stock market capitalisation.

3 REITs authorised

Last year the commission authorised 238 funds and three REITs. At the end of December 2005, there were 1,964 authorised unit trusts and mutual funds, excluding REITs, with total net asset value of $5.21 trillion, up 21% on 2004.

Last year's fourth quarter saw the takeoff of the local REIT market. To date, four REITs managed by licensed corporations here have been successfully launched and listed on the Stock Exchange. The commission also authorised the first bond index-tracking exchange traded funds in Asia under the Asian Bond Fund 2 project.

The successful launch of these two funds has raised public awareness and interest in bonds and increased their investment choices. It also marked an important milestone in the city's drive for the development of a deeper bond market.

Go To Top

|