|

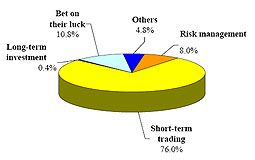

| Trading objectives: Most warrant investors used warrants for short-term trading, and 10.8% admitted they knew nothing about warrants and simply bet on their luck. |

Nine out of 10 investors are aware that derivative warrants are highly risky, and many traded consciously based on their own analysis, according to a Securities & Futures Commission survey.

The Warrant Investor Survey, conducted over the past two months covering 250 warrant investors, aims to ascertain retail investors' objectives of trading derivative warrants, their knowledge of the product and whether they gained or lost.

The survey showed 4.7% of Hong Kong adults, or 12.9% of retail investors had traded warrants during the last two years. By estimation, there are about 270,000 warrant investors in the city.

Among them, 92.4% perceived derivative warrants as a high risk or very high risk product while 76% said they had some knowledge about warrants and hoped to make short-term gains. The survey also showed 8.4% used warrants for risk management or long-term investment purposes, and 10.8% admitted they knew nothing about warrants and simply bet on their luck.

Trading history

On trading history and understanding of warrants, 73.2% of warrant investors had been trading warrants for more than 12 months. More than half said derivative warrants accounted for less than 10% of their investment portfolios while 76% understood the underlying asset's price is not the only factor that affects the price of a warrant. Less than half understood that a higher implied volatility indicates a derivative warrant is more expensive.

Warrant investors chose warrants as an investment tool mainly because of their higher volatility and better liquidity. In selecting a specific derivative warrant, 76.8% of investors said they did their own analysis, 19.6% influenced by market commentators' views in the mass media and 14.8% by friends or family members. Only 8.4% and 8% considered recommendations of issuers and brokers.

About 83.6% of warrant investors usually compared similar warrants before deciding to trade a particular one.

Some gain, some loss

On trading results, 30.8% said they had made a net gain in the past 12 months, 47.2% a net loss, 12% broke even, and 10% said they did not know. Despite the losses, 47.5% of loss-making warrant investors expressed they would continue to trade warrants. Among them, 53.6% said they understood the risk of investing and were prepared to take the risk while 41.1% believed they had learnt more about warrants and hoped to do better in future. About 37.5% hoped to recover their losses from further trading.

Securities & Futures Commission Chairman Martin Wheatley said risk awareness and product understanding are important areas in the commission's investor education work.

Noting there is a need to enhance investor understanding of this product and the use of warrant analytics, he said it is important for all parties - regulators, market operators, warrant issuers and brokers - to work together.

|