|

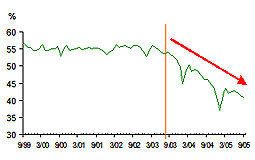

| Big dive: The percentage of rollover amounts to the total amount of card receivables dropped from 54% to 41% since the launch of positive data sharing. |

|

Positive credit data sharing has brought demonstrable benefits to consumers, Monetary Authority Chief Executive Joseph Yam says.

In his latest Viewpoint column, Mr Yam said assessment results suggest the impact of the two-year moratorium, during which credit providers are not allowed to access their customers' credit data, is not significant.

"The moratorium was a necessary arrangement designed to moderate the working of market forces for a time. Still, the market is moving in the right direction, at least as far as consumer benefits are concerned. The pace of the market change might have been slowed and the route more convoluted than otherwise, but consumers still stand to gain."

Between the start of positive data sharing in August 2003 and September last year, credit card receivables rose nearly 10% from to $59 billion. Rollover amounts fell 17% to $24 billion while the rollover ratio took a big dive from 54% to 41%.

Non-card credits surge

However, non-card credits surged 38% to $40 billion from December 2003 to December last year. This showed a large amount of credit card rollovers had been substituted by non-card credits during the period, and this trend has continued since then.

Noting the market share of non-bank financial institutions in the non-card credit market went up from 25% to 30% during the same period, Mr Yam said such non-bank players have been spearheading the substitution.

"These smaller institutions were not burdened with big existing loan portfolios. They could therefore take advantage of the moratorium and act aggressively to offer loans to consumers for paying off their credit card debts at much lower interest rates. Positive data sharing has enabled them to do this. Without these data, they would not have been able to manage and price their risks."

Interest savings substantial

He said a very large amount of credit card rollover has apparently been substituted by non-card credits with significant interest rate differentials, about 6-10% according to the market. The average interest rate for the remaining credit card rollovers has remained mostly flat. Therefore, the interest savings for consumers are likely to be substantial.

"Now that the moratorium is over, there are signs that banks and the bigger financial institutions are fighting back. There are also new players joining the consumer credit market. I believe this is good news for consumers because they are likely to benefit from more competition," Mr Yam said.

Go To Top

|