|

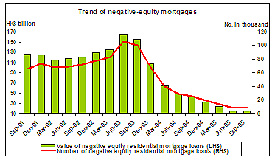

Continuous drop: The number of negative-equity mortgages dropped from 106,000 in June 2003 to 9,000 last September. |

Monetary Authority Chief Executive Joseph Yam says the recent rise in negative-equity mortgages will not affect the banking sector's stability.

In his Viewpoint column published today on the authority's website, Mr Yam said the introduction of mortgage insurance has enabled banks to lend more than 70% of the value of the property.

"To make it convenient for borrowers, banks increasingly provide a one-stop service and lend, say 90% and spread the risk in excess of 70% by arranging mortgage insurance for the borrower and charging him accordingly, either separately or by adjusting the mortgage rate for the loan as a whole.

"It is this change of practice that has made the negative-equity mortgage numbers that we compile more sensitive to changes in residential property prices."

Well-managed risk

Mr Yam said the exposure of the banks to the residential property market, through extending mortgages, has not changed in proportion. The risks to the banks remain well managed under the 70% loan-to-valuation guideline.

"So, if we see further increases in the number of negative-equity mortgages on the books of the banks, this does not necessarily mean a corresponding deterioration in the quality of the banks' mortgage loan books.

"Insofar as the burden on the borrowers is concerned, the number has, nevertheless, become a more realistic measure."

In June 2003 there were 106,000 negative-equity mortgages with $165 billion outstanding. Last September there were 9,000 with $16 billion outstanding.

"In that context, the increase of 300 in the third quarter of 2005 does not look alarming."

|